According to the United States Federal Trade Commission (FTC), debt collectors are responsible for the highest number of fraud cases reported to the agency.

One such agency is Aterso01, purportedly a branch of Convergent Outsourcing Inc., which operates as a debt collection agency.

Recently, there has been a lot of controversy regarding Aterso01’s legitimacy and dubious acts. Numerous questions have also been raised regarding its connection to Convergent Outsourcing Inc.

To make matters worse, several allegations, complaints, evidence, and trends used by Aterso01 to get hard-earned funds from consumers dubiously have surfaced online. Many victims claimed they received letters from Aterso01 to settle non-existing debts or bills already paid.

Some other victims said they did not know or have never been in contact with companies Aterso01 letters claiming they owed. Some also talked about the harassment they received.

Who should be believed?

In this review, we will disclose all you need to know about this dubious scheme by the Aterso01 debt collection agency and if they are a fraud. We also show you possible ways of staying off their grid and harassment.

Is Aterso01 Scam?

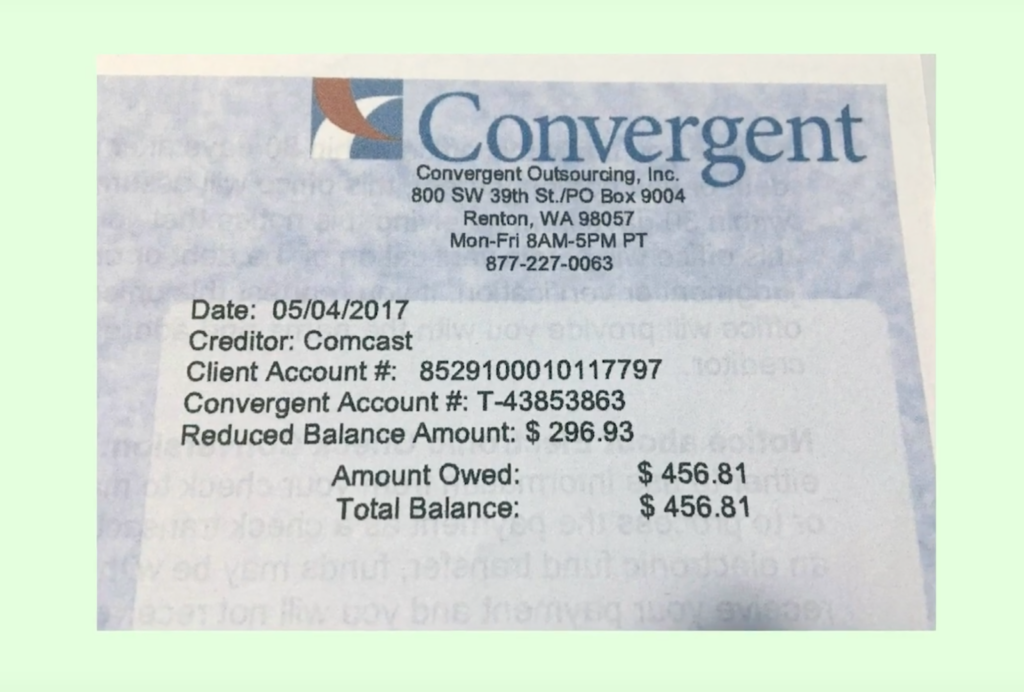

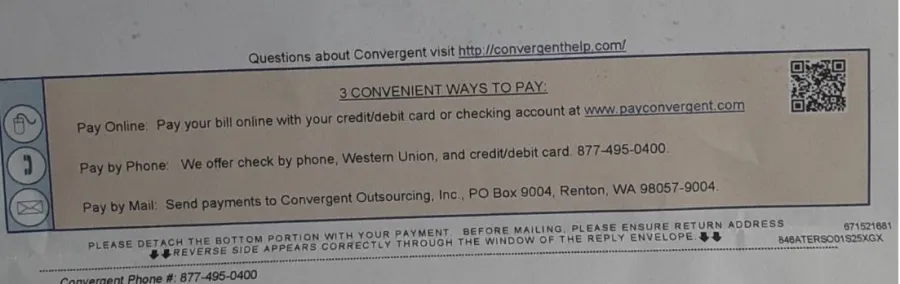

Based on the information gathered from the Better Business Bureau and images of some consumers’ suspicious letters from Aterso01, their postal address is PO Box 1280 Oaks, PA 19456-1280.

However, this particular address is reportedly believed to be owned by the Commonwealth Health Billing Office in Oaks, Pennsylvania.

Aside from that, Aterso01 is not BBB accredited and even scores ‘F’ on BBB, with an average rating of 1.37/5.00 from about 30 reviews.

The link between Aterso01 and Convergent Outsourcing

Many people who got letters from Aterso01 also saw the address of Convergent Outsourcing Inc. on the letter.

Aterso01 probably hacked into a convergent Outsourcing system to usurp funds. Others believe they are a scam, mainly because most of the information they claim they received is false.

According to the BBB website, Aterso01 is one of Convergent Outsourcing’s 25 branches. However, it is the only branch whose name is unrelated to Convergent, making it look strange.

The Aterso01 and Convergent Outsourcing have the same headquarters at 800 SW 39th St, Renton, Washington 98057-4975.

The two organizations also share the same website address, though BBB believes Aterso01 is out of business at the time of writing.

Convergent Outsourcing, using mail and telephone, has collected debts for the government, communications, healthcare, finance, retail, insurance, utilities, travel, and property management companies for about 74 years. It is also a collector on the US debt collectors list. However, Aterso01 is not.

Therefore, Aterso01 is believed to be a branch of Convergent Outsourcing Inc.

Alleged Dubious Practices of Aterso01 and Convergent Outsourcing Inc.

These practices led to legal actions and scrutiny from state attorneys general, emphasizing the importance of compliance with consumer protection laws.

1. Lawsuits against Convergent Outsourcing for Dubious Practices

Several lawsuits have already been filed against Aterso01 or Convergent Outsourcing Inc. The government – the State of Washington- filed one such lawsuit against Convergent for sending misleading letters to Washingtonians. Convergent will have to pay $1,675,000 for these misleading letters.

The letters they sent contained words like ‘settlement’ used to manipulate consumers to respond to settling the debt to avoid facing legal consequences. They also included some duration for consumers to respond, which shows urgency.

However, those letters were deceptive as those debts have passed the limitation status. While Convergent could still ask for the debt payments, they cannot file collection lawsuits for those debts.

Another typical example of such a lawsuit is JUAN OROZCO, individually and on Behalf of All Others. Similarly, Situated vs. Convergent Corporation Inc. by the Fair Debt Collection Practices Act (FDCPA).

Convergent Corporation Inc. allegedly sent a debt collection letter containing false, deceptive, and misleading information to manipulate Juan Orozco into paying his debt.

2. Complaints against Aterso01 or Convergent Outsourcing

On many review sites, victims of these dubious acts have shared their bitter experiences with Aterso01. Some consumers paid the non-existent debt, many did not, and others disputed it or sought legal solutions.

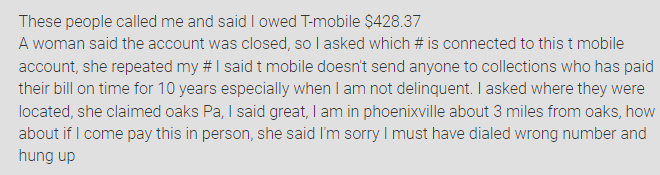

On SCAMPULSE, a consumer talked about how a supposed agent of Aterso01 terminated the call, knowing the individual could not be tricked by their call to settle a debt. The consumer had requested to go to their alleged office in Oaks to pay the debt when the Aterso01 agent hung up.

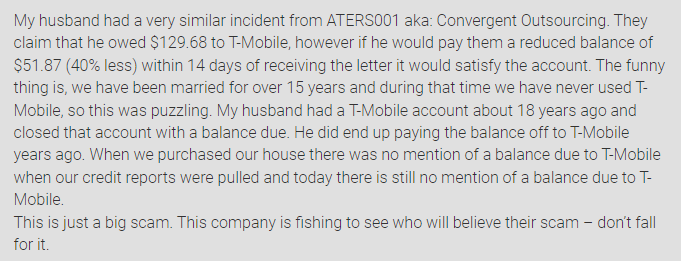

A woman explained how Aterso01 tried her husband of a non-existing debt for a T-mobile phone. She added that Aterso01 is just using the trick of asking people to pay non-existent debts.

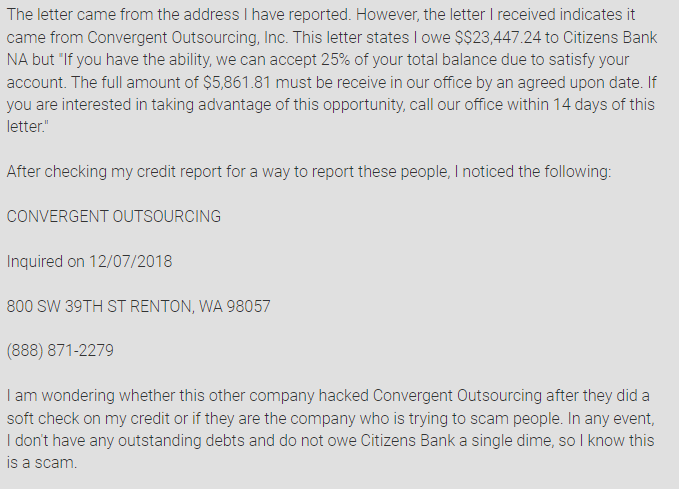

Another person claimed that he received a false letter from Aterso01 after Convergent Outsourcing checked his credit score and believed that Aterso01 was a scam.

On another review platform, a woman revealed that her grandson got an Aterso01 debt collection letter stating the grandson was in debt to a company the lad did not even have an account with.

On BBB, a consumer also talked about the harassment she received from Convergent Outsourcing.

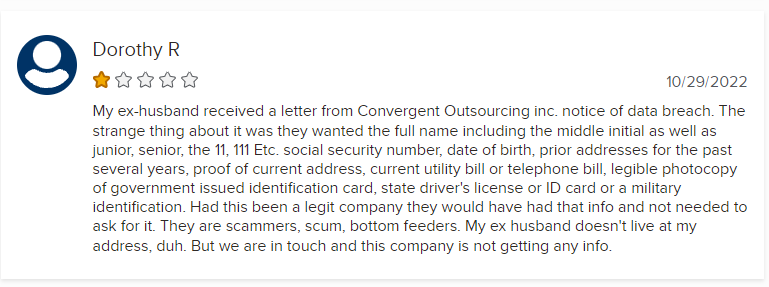

Dorothy, another consumer, talked about how Convergent Outsourcing kept asking for personal details of her ex-husband, which was illegal.

A woman also shared a similar experience, which made the collector agent drop the call after the consumer claimed she did not have a citizen bank account, which they claimed she owed.

Many other reviews on BBB talked about how disappointed they are with Convergent Outsourcing, who seem not to pay due diligence in getting their debt records right. However, there are about two exceptions credited to Convergent Outsourcing for assisting them in settling their debts.

How to Handle Aterso01 or Convergent Outsourcing Inc. Dubious Practices

When you receive debt collection letters or calls, especially from Aterso01 or Convergent Outsourcing, it is good to do the following:

- Confirm the call is genuine or the letter is coming from a legit company before setting any debt through the online method, phone, or mail.

- Please do not give them your personal information when they call you; it is a way of trying to frame some debt on you.

- Do not purchase any item you do not trust, as you could incur debts from the previous owner.

- When unsure if you owe the creditor, send a debt validation letter via certified mail asking them to confirm the debt details. Ask them to include the amount owed, the name of the creditor, and the original date of debt acquisition.

- Certified mail helps you get a receipt confirmation and create a paper trail. After mailing them, seize negotiation till they respond. Be careful while checking through the validation letter for any inaccuracies, for which you can file a dispute.

- If the debt is not yours, write them, telling them it is not yours and that they should stop contacting you.

- If the threat persists, you could also file a complaint with the credit bureaus such as the Consumer Financial Protection Bureau.

Consumer Protection Rules from Debt Collection Agencies like Aterso01

You must know your right to be free from debt collectors’ grip. The Fair Debt Collection Practices Act (FDCPA) is a national law that defines how much debt collectors’ agencies can collect debts for personal, family, or household purposes.

Some of the rules include:

- Debt collectors are allowed to call you only between 8 am and 9 pm and cannot reach you more than seven times a week regarding a particular debt. They are also not allowed to contact you when you are in a place not convenient for you to receive their calls, such as the workplace.

- They are not allowed to post anything regarding your debt on social media, though they can reach out to you on social media private chat; you can also ask them not to reach out to you through that means.

- A debt collector is under obligation to talk to your attorney rather than you in cases where they are aware you have an attorney.

- They are not to be abusive, mistreat you, or use foul language against you.

- They are not to threaten, lie, or make a misleading or false statement regarding the amount you owe.

- Debt collectors must not misrepresent themselves or credit-related information.

Ways of Improving Your Credit Score Damaged by Convergent

Many consumers allege that they have to pay Convergent Outsourcing Inc. in exchange for having all debt-related information deleted from their credit files. If you have paid what you owed to the original creditor, you can first request a goodwill deletion of the debt collection.

You can also ask a credit repair company to repair the credit score if Convergent proves they are a hard nut to crack. The credit repair company will discuss with the debt collection company to remove the negative mark on your behalf. You can also seek legal advice if all ways seem abortive.

Wrap-Up

While many consumers doubt Aterso01, it is widely regarded as a branch of Convergent Outsourcing. However, know your rights regarding debt collection and consider disputing the files at the credit bureau when you notice foul play. Also, validating any debt collection letter from these agencies is good to avoid being ripped off your hard-earned funds.